Understanding boat insurance claims

With the sneaky cold winter in Canada, the boating offseason can be long and tiresome. Boaters are eager to get their boats out on the water to make memories with their family and friends. A boating incident that leads to a boat insurance claim can put a damper on the fun; however, we recommend that every boat owner purchase a specific boat insurance policy to protect you against accidents, damage, or theft, which gives boaters peace of mind when they are on the open water.

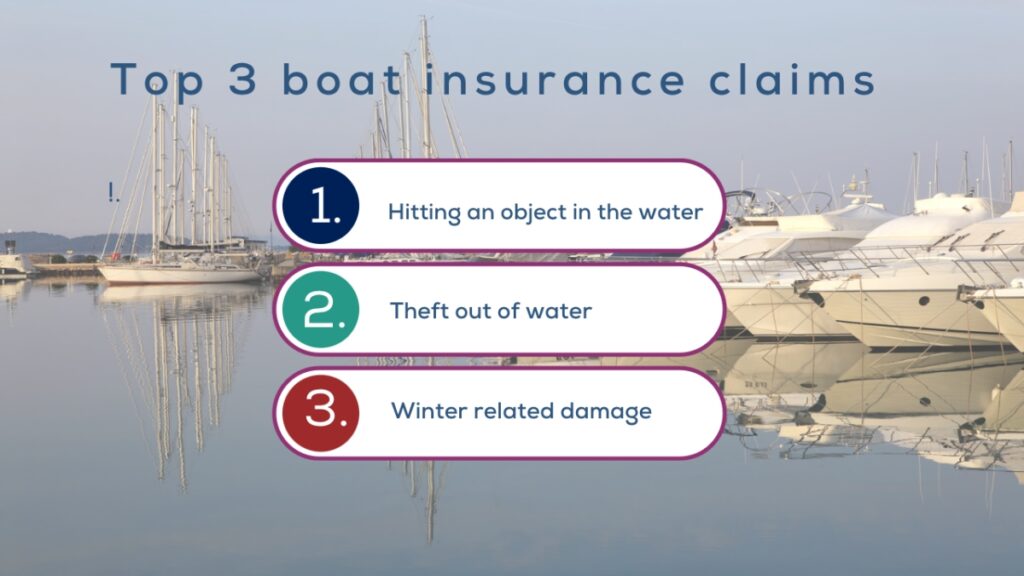

Three of the most common boat insurance claims

The top three boating claims are often preventable. Take steps to prevent these claims form happening to you:

1. Hitting an unexpected object in the water: This type of incident is most common in the spring when levels of water are high due to the spring run-off. Loose logs and debris can happen at any time of year. Avoid areas of high debris, be cautious when boating in unfamiliar areas and have a spotter on the boat.

2. Theft out of the water: Take high security measures to protect your boat when it is out of the water. Learn more about best practices to avoid theft claims.

3. Winter related damage: In the fall it is key to winterize your boat. Taking the time to winterize will help avoid cracked engine blocks, damage from frozen water and winter storms, mold and electronic damage.

An important incentive to do your end-of-season boat maintenance: damage due to or poor winterization is typically not covered under your insurance policy.

Typical boat insurance coverage

For a privately owned pleasure craft, your boat insurance may cover the following:

- Hull and Machinery – provides damage coverage up to the total loss of your boat.

- Protection and Indemnity – provides liability coverage that protects you against property damage bodily injury. It also provides help with investigating a loss and preparing your defence. If you are found to be at fault, it provides payment up to the limit listed in your policy.

- Medical Payments – provides coverage for incidental medical expenses due to an incident on your boat

7 Key points to understand about boat insurance claims

- Reporting the incident: As soon as an incident occurs, it’s important to contact your insurance provider and report the details of the incident. Prompt reporting helps initiate the claims process and allows the insurer to guide you through the necessary steps. Refer to the Safe Harbour Insurance Claims process.

- Documentation: When filing a boat insurance claim, you’ll typically need to provide documentation and evidence of the incident. This may include photographs or videos of the damage, a police report (if applicable), and any relevant information related to the incident, such as witness statements or weather conditions. The more documentation you have the better.

- Claim adjuster: The insurance company may assign a claim adjuster to assess the damages and determine the value of the claim. The adjuster will typically review the documentation provided, visit the boat, and assess the extent of the damage.

- Repair estimates: The insurer may require you to obtain repair estimates from reputable repair shops. These estimates will help determine the cost of repairing the damages or replacing any lost or stolen items. It’s important to communicate with your insurance provider regarding which repair shops are acceptable for obtaining estimates.

- Settlement and compensation: Once a claim has been assessed and approved, the insurance provider will typically offer a settlement amount. This may cover the cost of repairs, replacement, or compensation for other covered losses. The settlement may be based on the actual cash value (ACV) of the boat, or an agreed-upon value stated in the policy.

- Deductible: Keep in mind that most boat insurance policies have a deductible, which is the amount you’ll need to pay out of pocket before the insurance coverage kicks in. The deductible is typically subtracted from the settlement amount.

- Claims process timeline: The timeline for boat insurance claims can vary depending on the complexity of the claim, the extent of the damages, and other factors. It’s important to stay in contact with your insurance provider and follow up as needed to ensure a smooth claims process.

It’s worth noting that specific details and procedures may vary depending on the insurance company, policy terms, and the circumstances surrounding the claim. It’s important to carefully review your boat insurance policy and contact your Safe Harbour Insurance Broker directly to understand the exact process for filing a claim and the specific coverage provided under your policy.